What's the maximum i can borrow mortgage

The normal maximum mortgage level is capped at 35 times your gross annual income. Our mortgage calculator will help you work out how much you can borrow when applying for a mortgage.

Car Title Loans In London Instant Loans Canada Instant Loans Loan Credit History

Our mortgage calculator can give you a good indication of the amount.

. View your borrowing capacity and estimated home loan repayments. That way you can. According to the Forbes Advisor mortgage calculator.

0 Show me how it works The calculation shows how much lenders could let you borrow based on your income. The amount you spend to repay credit and store cards catalogue purchases loans overdrafts maintenance and your pension. In certain circumstances you.

Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home. You dont need to tell us about general household spending. To be able to get a mortgage of 100000 you.

So to buy the average UK house costing 250000 youd normally need at least a 25000. For example when income levels are above 50000 lenders will significantly increase the lending available as this level of earnings is in the lenders eye likely to have significantly more. The 30-year jumbo mortgage rate had a 52-week low of 519 and a.

How Many Times My Salary Can I Borrow For A Mortgage. How much can I borrow. For example if your gross salary is 80000 the maximum mortgage would be 280000.

Estimate how much you can borrow for your home loan using our borrowing. There are two main factors that are taken into consideration to determine how much of a mortgage payment you can handle. Whilst the typical borrower can expect to be offered between 4 and 45 times their salary its possible to find lenders willing to offer more than that.

For instance if you have a 420000 mortgage the maximum amount you qualified for then you should look for homes with a selling price of around 380000. For example if you earn 30000 a year. At this time last week it was 582.

This is a percentage that shows the split between your mortgage and the loan amount after youve paid your deposit. When you apply for a mortgage lenders calculate how much theyll lend. Typically you need at least 10 of the homes value as a deposit to get a mortgage.

A general rule is that these items should not exceed 28 of the borrowers gross income. The current average interest rate on a 30-year fixed-rate jumbo mortgage is 605 010 up from last week. The Sean Zalmanoff Mortgage Teamspecializes in making the home purchase or refinances process a great experience whether your first purchase your 10th or needing.

Heres why APR is important. The maximum you could borrow from most lenders is around. Lenders will typically use an income multiple of 4-45 times salary per person.

These are your monthly income usually salary and your. Some lenders will use multipliers slightly lower or higher than this but we believe this represents a mid-point to give you a good indication of how much you may be able to borrow. And the most youll be able to borrow with a conventional mortgage would be 90 of the price which in your case would be 63000.

For example if you are buying a house worth 200000 and your deposit is. The 30-year fixed mortgage APR is 593. We calculate this based on a simple income multiple but in reality its much more complex.

However some lenders allow the borrower to exceed 30 and some even allow 40. This varies between banks however the standard offer is three times your income for a mortgage based on a single salary and 25 times your income for a joint salary mortgage. How much can I borrow.

The amount you can provide as a deposit Your household income Money you owe because of loans credit cards or other commitments Whether youre buying alone or with someone else.

How To Get A Mortgage Without Financially Freaking Out Mortgage Tips Freak Out Mortgage

What You Need To Know About 401 K Loans Before You Take One

Dont Miss Out On This Little Known Gem Known As Hud Reo Program Reo Properties Marketing Trends Foreclosures

Bwsoeu 8pgnfjm

Why Be Preoccupied With What We Can T Achieve For The Time Being When We Can Become What We Can Live With Effort And Persistence In 2022 Persistence Achievement Effort

Pin On Ontario Mortgage Financing

Mortgage Do S And Don Ts Mortgage Mortgage Tips Mortgage Advice

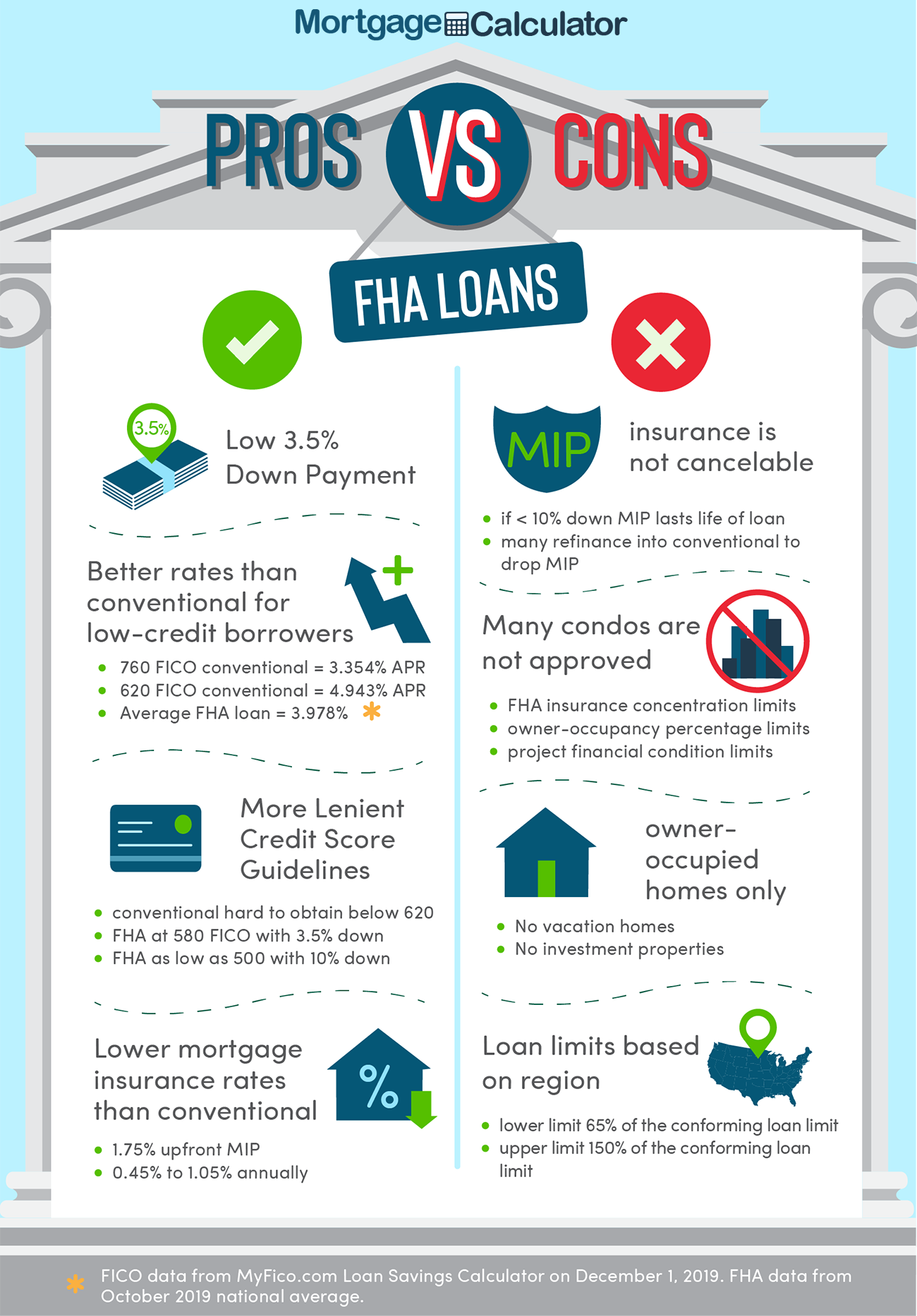

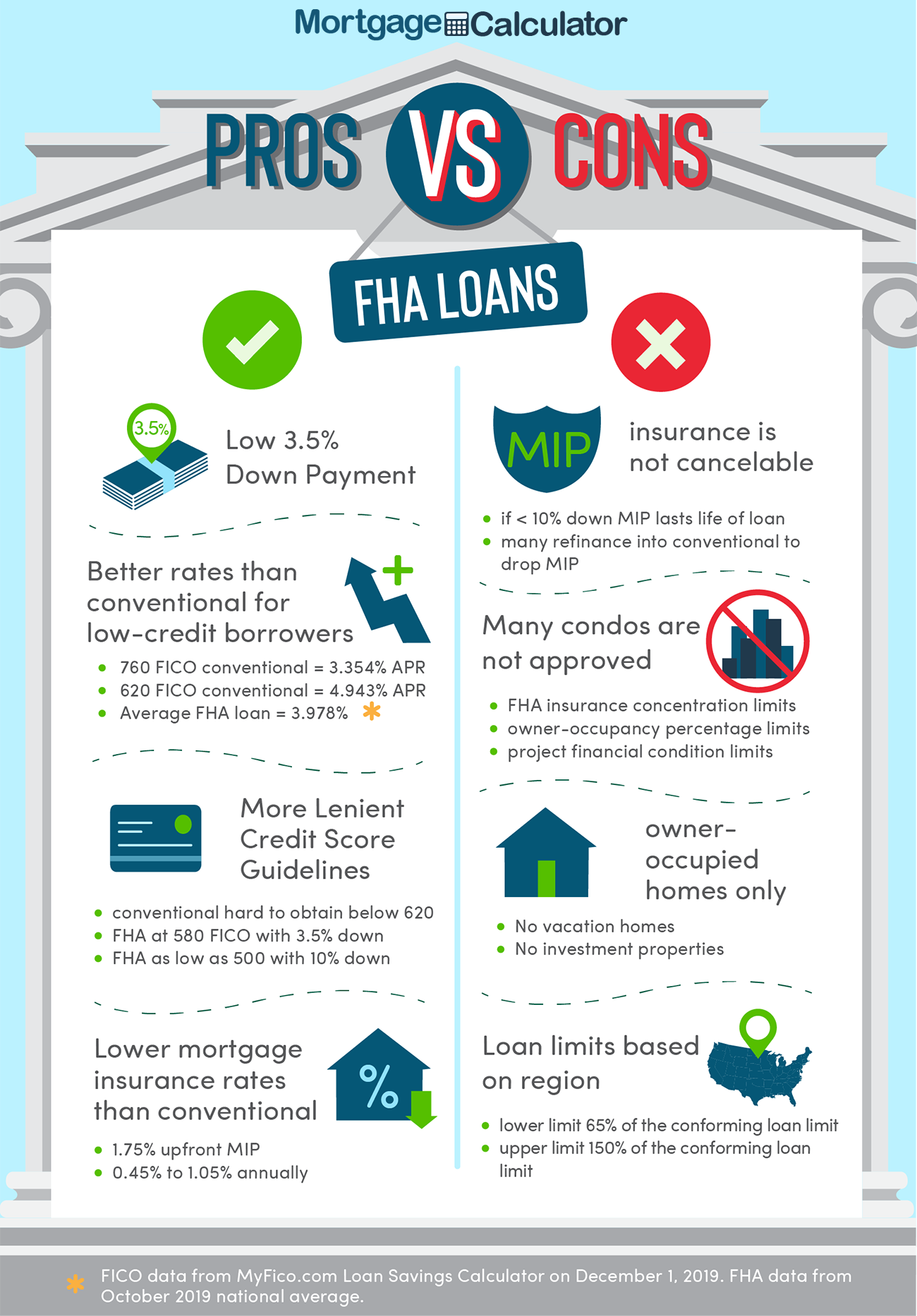

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Tips For Picking A Loan Term For Your Home Mortgage Home Mortgage Mortgage Mortgage Tips

Financial Management Tip Borrow Smart Financial Management The Borrowers Management Tips

Great Information For You First Time Homebuyers Qualify For All Four Apply Here Loanfimortgage Com Understanding Mortgages Mortgage Bad Credit Mortgage

Online Cash Advances Software Apps Linux

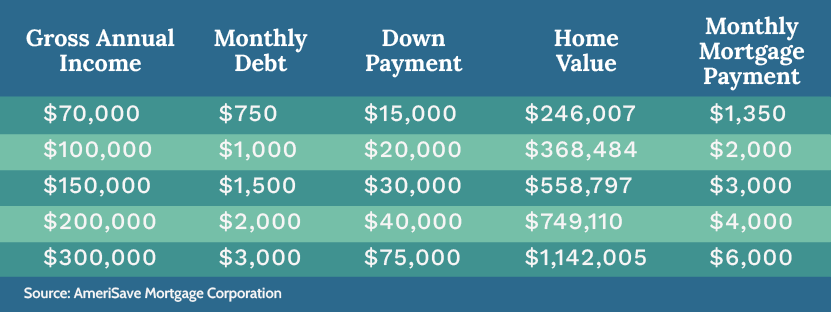

Calculate How Much You Can Afford Home Affordability Amerisave

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Mortgage Calculator How Much Can I Borrow Nerdwallet

Pin On Ui